The content you include in your investor deck will vary slightly depending on whether it’s an angel, seed round, Series A, Series B or subsequent stages of venture capitalist fundraising. But regardless of your company’s end goal, it’s important to avoid common pitfalls that could easily make an otherwise great pitch deck fail you. Here are five slides you should ditch in your next investor pitch deck.

Don’t talk about acquisition or potential buyers too early

Of course you have been testing different acquisition sources and tracking where your users are coming from. Obviously you want to demonstrate your ability to develop long-term customer acquisition strategies and highlight which channels do and don’t work, but the common mistake many presenters make is jumping into it too early. Make sure to describe the problem first and clearly outline your value proposition. If the investor is not convinced the problem is real and your solution is both feasible and timely, any customer acquisition success will seem circumstantial, and any long-term acquisition strategies you propose are unrealistic.

Don’t worry about traction at the seed stage

Traction and product-market fit are two things that are often confused. Many companies have traction but very few have product-market fit. That’s because early traction can be a temporary or accidental success, often boosted by circumstances such as personal and industry connections of one of the founders.

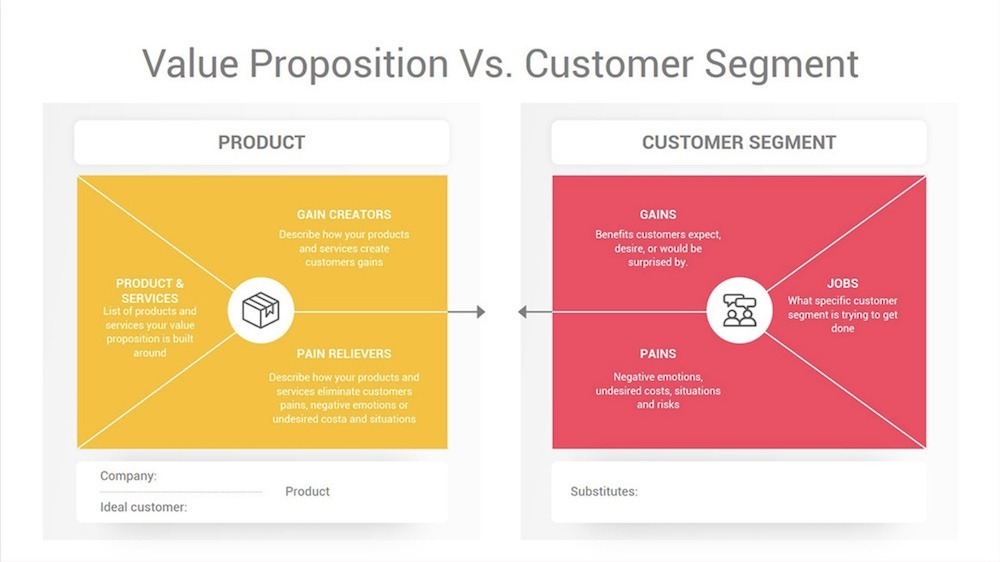

On the other hand, if you manage to demonstrate that you’ve reached the stage of product-market fit, you’re showing that you’ve found your ideal target market and are developing the perfect solution to their problem.

To demonstrate proof of product-market fit, ask yourself the following questions (and make sure to include the answers in your presentation):

- Do your customers recommend your product to others?

- Do they bounce, and how often?

- What are the key metrics for customer success (aka conversion)?

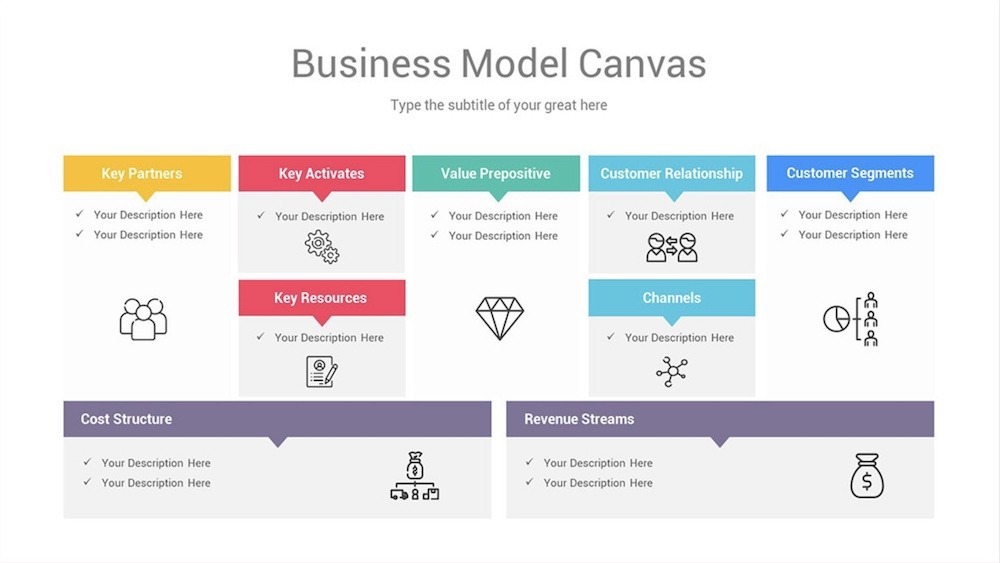

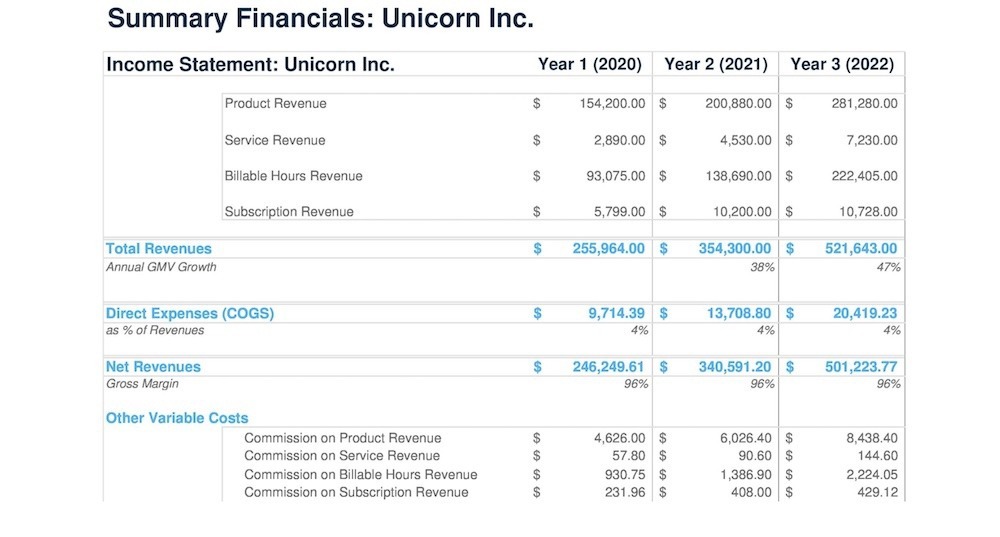

Don’t talk about financial projections without having clear comps

Many start-up founders think that they need to be aggressive in their financial projections because investors will haircut their forecast. Sure, it’s true, they will haircut your forecast. But it still has to be realistic if you want to get any funding at all. Stating that your revenue will grow from zero to $100 million in the first two years is not realistic. Be optimistic but honest. Make sure to include your upcoming expenses as well as your projected cash flow.

We realise we may believe we have a unicorn company, yet, we don’t need to be there tomorrow. Realism is your ally. If you build a business with a true growth strategy, a researched thesis as to how you’ll achieve and demonstrate “we’re going to get there, yet with capital, we’ll get there quicker and more efficiently”.

As a rule of thumb, many growth-stage investors (Series B and beyond) follow the “The Rule of 40” to assess the growth of fast growing start-ups. According to this rule, the company’s combined growth rate and profit margin should be at least 40%.

Don’t ask for a specific sum of money

Likewise, when you ask for a specific sum of money, be realistic and be willing to explain how the money is going to be used. Include answers to these questions in your presentation (or be prepared to elaborate): How much money would you like to raise? Why this amount? What exactly will you do with it and how long will it last? Be sure to mention any upcoming hires, or tools and services that you will need for your business to grow and run smoothly.

My advice is to place a bracket i.e. between $5m and $10m then discuss the definitive rationale of both.

Don’t forget to mention the team

The team behind your start-up is the soul of the company. They are just as (if not more) important than your brilliant idea. A common mistake first time entrepreneurs often make is to stop after mentioning the founder and the co-founder.

Potential investors want to know not only about the founders of the company but about the team members, too. Explain what experience and skills they bring to the table, their motivation and enthusiasm, and why they’re a valuable asset to your company.

Talk about the members of your team and any anticipated additions down the road. Briefly add what each member brings to the table, to help move the vision forward and the company grow.

As mentioned previously, you business will change direction at least once before you ‘make it’, yet with a strong team with you will allow this adaptability to be on the journey with you through this transition! The stronger you are as a unit, is defendable.

If you’re at a stage where you have the contents ready, but feel a conversation of structure, design and content, reach out and I’ll help you.

Thank you for reading.

A.