Choosing the right design agency is crucial. You don’t want to be hopping from one to another, disappointed, frustrated and with a depleted budget. This article offers advice on how to choose the right branding agency for you.

In my previous life I heard far too often comments like “we invested in a brand a year or so ago, and we need to do it again, but we’ve spent all our budget“. When I say we heard that a lot – it was a modest claim – it was every month… for years.

The comfort is; you didn’t know better, nor should you have done. You met a superb sales guy that over promised and under delivered. That’s all, however, you’ve learned a lesson.

Don’t see building a brand as a cost, but an investment – think about what you have sacrificed to get here, and that doing it right this time will hold you in good stead for the years to come.

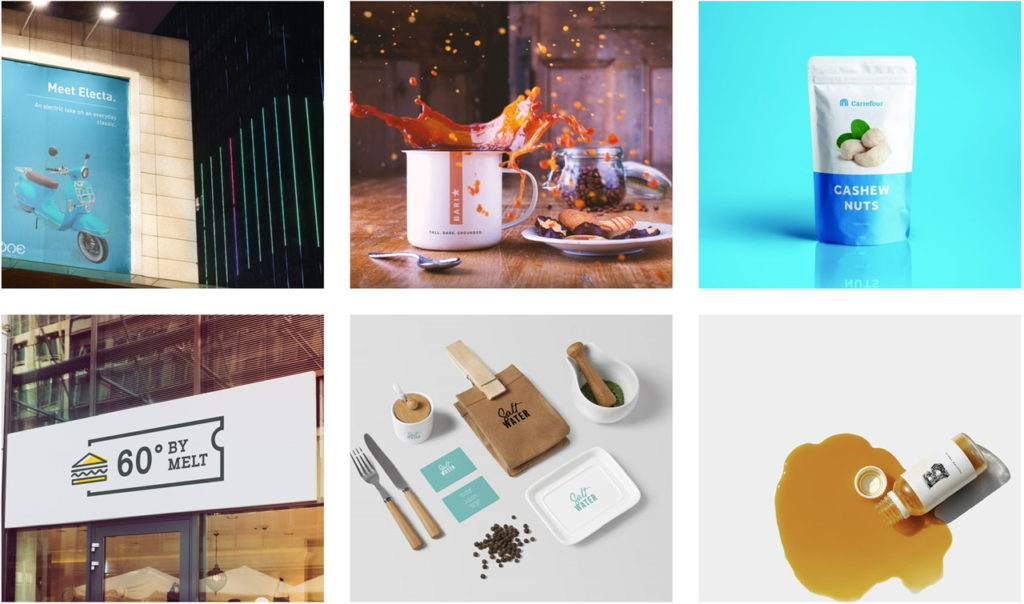

To get the most out your branding agency – whether it’s for a brand refresh or new creation – research them, do your due diligence. Don’t just look at a portfolio and be wowed by the design, understand who you are going to trust with your investment.

My Top Three Tips:

1. Build rapport

Take off the business owner’s hat for a moment and think of yourself as a customer (which you are). As a customer you buy from people you like, so build a rapport with them, respect their time and ensure they do yours. Once you grow to like them, through experience, knowledge and above all else, wisdom in branding – then make your decision with confidence.

To help this flow, one thing a lot of customers request are designs, ideas, suggestions at no charge. In order to win the customer’s business, agencies are asked to give a lot without charging. This should be considered: “If an agency is prepared to give you a lot before you commit, they probably aren’t the right agency for you. They will probably make up for this time in the final invoice, which will cost you more.

Our advice: once you’ve solidified a brief – managing expectations and deliverables – then commit. You have already built rapport and confidence.

2. Experience and Passion

Consider this; you can choose a large agency, with large overheads who will produce great work, yet the investment may well be out of budget.

You could choose a small design studio who will do anything you ask as they are hungry for work, it’ll fit on budget but not on quality or expectations.

Or consider freelancers. Those great designers, have little security and therefore often, take on too many jobs to secure that month’s income, miss deadlines and affect your business development.

Lastly, choose a smaller agency who have the big agency experience and client portfolio, who have successes in business themselves, absolute passion for what they do, so can support you in your business.

If they have passion for your business, it’ll show, plus, the more support you have in business the better, right?!

3. What else can they offer?

When answering, “how to choose the right branding agency?” consider a few points:

- Do you just want the design?

- Do you need additional support?

- Do they have a network who can help? Do they offer other services that might benefit our business?

Once these are answered, it’ll also help you select the right agency for you.

You may find you’ll choose an agency that specialise in branding and design, however, they will also support you with their network of digital experts, signage manufacturers, social media support, content development, marketing strategies and others.

If you are ready to discuss your business with a branding consultant who truly cares, and discuss the small print of life over a coffee, then contact me and build the right for your customers.

Thank you for reading.

A.